FREQUENTLY ASK QUESTIONS

Frequently Ask Questions

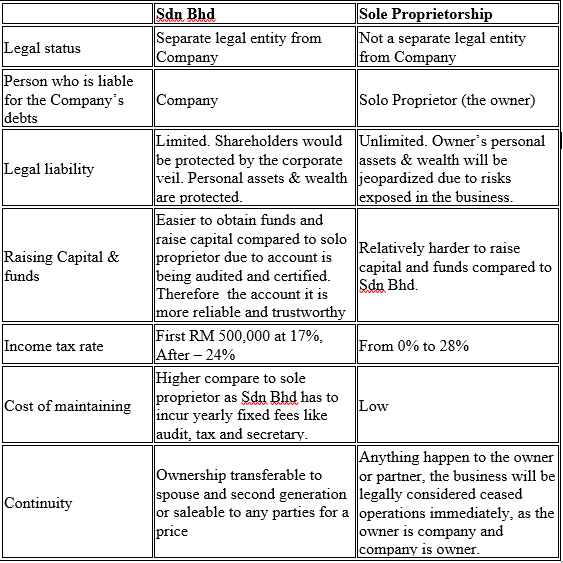

Malaysia private limited company or “Sdn Bhd” is the most common and popular type of business type where investors or entrepreneurs seek to setup. Refer to below table on the pros and cons for setting up Sdn Bhd.

Sdn Bhd VS Sole Propriertor

To summarise the advantage and disadvantage of Sdn Bhd will be

Advantage

- Separate legal entity and owner’s wealth will be protected

- Easier to expand the business and raising funds in future

- Exposed to lower income tax risk (enjoy lower tax rate)

- Able to transfer the ownership and saleable

Disadvantage

Higher maintenance cost compare to other business vehicle. However, it will worth every penny and effort spend due to the lower income tax risk and separate legal entity which able to protect the owner of the business if business goes wrong (ie: get sued or bankrupt).

- You can drop us an email on the incorporation information located at FAQ 5. Or you may call us for faster process and clarification

- We will proceed check the availability of the business name and be in touch with you

- Once all the information is complete, a quotation will be email to you to proceed the payment.

- Upon received on payment, we will proceed verification stage and incorporate the company with Companies Commission of Malaysia (SSM)

- Once the company is incorporated, we will inform and hand you all the relevant documents for records.

Based on our past experience, the whole incorporation process will take 5 to 10 working days.

Do note that, the incorporation timeline is very dependent to the completeness of the documents & information and also subject to the availability of the SSM’s online system.

Requirement to form a Sdn Bhd or private limited company are:

- A minimum of one director

- A minimum of one shareholder

- A company secretary who is certified and licensed under Companies Commission of Malaysia (SSM)

Below are the information required for incorporation

- At least 3 proposed business or company names

- Detail of the principle business activities (can be more than one activity)

- A photocopy of all the directors’ and shareholders’ I/C or Passport

- Details mailing address and contact number for all the directors and shareholders

- Supporting document like utilities bill or tenancy agreement if the residential address of the director is different from the I/C or passport

- Paid up capital information (min RM 1 to RM 1,000)

- Percentage of shareholding of each shareholders.

The person need to be

- Natural person

- Minimum aged of 18 and above

- He or she is not bankrupt and imprisoned

He or she is not convicted whether within or outside Malaysia of any offence

Once the Malaysia Company has been incorporated, you may start your business immediately. But here are the few things to take note:

- Opening bank account

- Register with Sales and Services Tax (SST) if necessary. The registration of SST is not compulsory unless the business annual sales if more than RM500,000.

- Register with EPF and Socso if you planning to hire staff for your business

- Hire a qualified accountant to manage the account when the business starts as the account need to be in proper stage for auditing and taxation purposes. We do offer accounting and consulting service with qualified accountant to assist you and your business. Depending on the Company’s volume of transaction, we offer bookkeeping services either on weekly, monthly, quarterly or yearly basis.

- To decide on the Company’s fiscal year end

The answer is yes. Foreigners are allow to setup or incorporate a Private Limited Company, Sdn Bhd in Malaysia. The procedure of incorporation is same as the local. You may refer to FAQ 2 for the procedure and FAQ 5 for the documents needed for incorporation of company in Malaysia.

Do note that, a foreigner will be consider as a resident director if his principal place or place of residence is within Malaysia or he has employment pass or permanent resident pass in Malaysia. This allows the foreigner to register him or herself as the sole director.

If the foreigner is not a resident director then the Company has fulfilled the requirement under Section 122(1) of the Companies Act, 1965 – must have at least two (2) director who each has his principal place or only place of residence within Malaysia. This section is mainly to ensure that there is a point of contact in Malaysia and the purposes of enforcement.

Ultimately, a Malaysia resident is refer to a citizen or a permanent resident of Malaysia or a person with employment pass.

Any person aged above 18 years old can be appointed as director and before a person can be appointed as a director, he must lodge with SSM a statutory declaration (Form 48A) declaring that he or she is qualified from being a director due to:-

- Being not an undischaged bankrupt;

- Not been convicted whether within or outside Malaysia of any offence (in connection with the promotion, formation or management of a corporation; involving fraud or dishonesty punishable on conviction with imprisonment for three months of more; or under section 213, 217, 218, 228 or 539, within a period of five years preceding the date of this declaration.

- Not been imprisoned for any offence referred to above within the period of five years immediately preceding the date of this declaration.

In short, a foreigner can be appointed as directors provided he is not disqualified from being a director.

- Acting as named Corporate secretary by our qualified professional staff (Malaysian)

- Safekeep company common seal, if any

- Maintaining the Minutes and Register Books

- Advice on secretarial/compliance/accounting/tax/SST matters

- Monitoring and ensuring compliance with relevant legal requirements, particularly under the Companies Act and Income Tax Act.